https://dfr.oregon.gov/news/news2022/Pages/20220819-student-loan-ombuds.aspx

Author Archives: dvenables

FREE Consumer Section CLE on June 16 & 17 – Preventing Home Foreclosures in Oregon

| Preventing Home Foreclosures in Oregon

Co-sponsored by the OSB Consumer Law Section and the Oregon Homeowner Legal Assistance Project, with support from Oregon Consumer Justice 1 p.m.–4:45 p.m. PDT, Thursday, June 16, 2022 9 a.m.–4:30 p.m. PDT, Friday, June 17, 2022 OR CLE credits: 8.75 General Cost: Free, but registration required In-Person Event: Oregon State Bar Center, Tigard or Live Webcast | Search for FORE22 in the catalog This two-part seminar will delve into historical information about homeownership preservation in Oregon, the state of foreclosure defense, and available resources in the wake of the COVID-19 pandemic. The introductory track on day one will cover the foreclosure process including early case assessment, loss mitigation options, and financial assistance for homeowners. Learn how to help reverse mortgage borrowers, litigate mortgage cases, and explore bankruptcy as a home preservation tool during the advanced track on day two. Register Here: In Person: https://ebiz.osbar.org/ebusiness/Meetings/Meeting.aspx?ID=5202 Webcast: https://ebiz.osbar.org/ebusiness/ProductCatalog/Product.aspx?ID=5205 Download Brochure: |

CFPB Issues Recent Advisory Opinion: ECOA Applies at All Stages of Credit Lifecycle

By David Venables

On May 9, 2022, the Consumer Financial Protection Bureau (CFPB) published an advisory opinion affirming that the Equal Credit Opportunity Act (ECOA) not only prohibits lenders from discriminating against borrowers who are actively seeking credit, but also prohibits discrimination against borrowers with existing credit. According to CFPB Director Rohit Chopra, this recent “advisory opinion and accompanying analysis makes clear that anti-discrimination protections do not vanish once a customer obtains a loan.”[1]

The CFPB is charged with interpreting and promulgating rules under ECOA and it enforces the Act’s requirements with rules known as Regulation B. See 15 USC §§ 1691b, 1691c(a)(9); 12 C.F.R. pt. 1002. Advisory opinions, such as this one, are one of many types of guidance documents that the CFPB issues to assist entities in understanding their obligations under the law. Not all courts have applied ECOA’s protections to cover existing credit accounts, however, and so the CFPB recently filed an amicus brief[2] in Fralish v. Bank of America, N.A., No. 21-2846 (7th Cir.). In Fralish, the district court had concluded that ECOA did not apply to those who previously applied for and received credit. Consistent with its rationale in this advisory opinion, the CFPB explained in its amicus that the text, history, and purpose of the Act clearly demonstrate that the protections do not disappear once credit has been extended.

Enacted in 1974, ECOA is a landmark civil rights law which aims to help protect people and businesses against discrimination when seeking, applying for, and using credit by banning credit discrimination on the basis of race, color, religion, national origin, sex, marital status, and age. 15 U.S.C. 1691(a). As noted in the advisory opinion, ECOA prohibits lenders from lowering the credit limit of existing borrowers’ accounts or subjecting certain borrowers to more aggressive collections practices on a prohibited basis.[3] ECOA also requires lenders to provide “adverse action notices” to borrowers which explain why an unfavorable decision was made and the advisory opinion makes clear that lenders need to provide such “adverse action notices” to borrowers with existing credit. See 15 U.S.C. § 1691(d)(2)-(3).

[1] https://www.consumerfinance.gov/about-us/newsroom/cfpb-issues-advisory-opinion-on-coverage-of-fair-lending-laws/

[2] The CFPB amicus brief was filed in conjunction with the Federal Trade Commission, the Federal Reserve Board of Governors, and the U.S. Department of Justice.

[3] https://www.consumerfinance.gov/about-us/newsroom/cfpb-issues-advisory-opinion-on-coverage-of-fair-lending-laws/

It’s National Consumer Protection Week (March 6 – March 12, 2022)

National Consumer Protection Week (NCPW) is a time to help people understand their consumer rights and avoid frauds and scams.

https://www.consumer.ftc.gov/features/national-consumer-protection-week

Rent-A-Bank Schemes in Consumer Finance Loans

By Anthony Estrada

In 2007, the Oregon Legislature capped the interest rate on consumer finance loans[1] at 36 percent, or 30 percent above the Federal Reserve discount rate, when it enacted HB 2871.[2] Despite these legislative efforts, a number of consumer finance brokers are using “Rent-A-Bank” schemes in partnership with out-of-state, state-chartered banks to circumvent the rate caps. The Oregon Division of Financial Regulation (DFR), which conducts financial examination of consumer finance brokers, has identified consumer finance loans with interest rates upwards of 178 percent!

The Federal Deposit Insurance (FDI) Act permits state-chartered banks to charge interest at the rate permitted by the state in which the state-chartered bank is located. However, this interest rate exportation may be challenged if the loan broker is determined to be the “true lender” of the loan.[3]

Rent-A-Bank schemes involve nonbank brokers utilizing out-of-state state-chartered banks as a conduit to originate loans to circumvent state usury laws. These nonbank entities list the state-chartered banks on loan documents, or claim to be acting as loan servicers on behalf of the banks, so they can enjoy the benefits of the exportation privileges that apply to national banks or out-of-state state-chartered banks. The bank will fund the loan and almost immediately sell it back to the nonbank, which will provide the majority of services typically provided by the lender.[4]

Several state attorneys general and courts have begun applying a “true lender” test to determine which entity is the actual, rather than nominal, lender. The analysis often focuses on which party has the predominant economic interest. Other factors include which party:

- Designed, brands, or holds the intellectual property on the loan product and collateral;

- Markets, offers and processes loan applications;

- Services the loan and handles customer service;

- Purchases, has first right of refusal, or ultimately holds the bulk of the loans, receivables, or participation interests; and/or

- Has the ability to change the entity that originates the credit or to whom the credits or receivables are sold.[5]

The Oregon Legislature, along with consumer organizations and advocates, recognizes that interest rate limits are the simplest and most effective protection against predatory lending. Certain consumer finance brokers are using Rent-A-Bank schemes to circumvent those limits and charge exorbitant interest rates to Oregon consumers. If you or a client suspect a consumer finance lender of charging excessive interest rates, consider the true lender analysis to determine whether there exists a cause of action. Finally, DFR regulates consumer finance brokers and may be a useful resource for guidance and information: dfr.oregon.gov

[1] A “consumer finance loan” is a loan or line of credit that is unsecured or secured by personal or real property and that has periodic payments and terms longer than 60 days. See ORS 725.010(2).

[2] See ORS 725.340(1).

[3] The exportation may also be challenged if the state in which the loan is made “opts out” of the interest rate exportation clause under the FDI Act. See 12 U.S.C. 1831d.

[4] For more information on Rent-A-Bank schemes, see the 2020 testimony of Lauren Saunders of the National Consumer Law Center before the House Financial Services Committee here.

[5] See Ubaldi vs. SLM Corp, 852 F. Supp. 2d 1190, Flowers vs. EZPawn Oklahoma, 307 F. Supp. 2d 1191, Glaire vs. La Lanne-Paris Health Spa, Inc., 12 Cal 3d 915, Eul vs. Transworld Systems, 2017 WL 1178537, George Cash America vs. Greene, 734 SE 2d 67.

Recent Oregon Foreclosure Moratorium Developments

On June 1, 2021, Governor Kate Brown signed into law Oregon’s most recent COVID-19 pandemic-related foreclosure moratorium, HB 2009. Although similar to last year’s statewide moratorium that expired at the end of last year, Oregon’s most recent moratorium is limited to only residential properties, staying foreclosures and retroactively voiding all such non-judicial foreclosure sales and sheriff’s execution sales that were conducted this year.

In addition to the ban on foreclosures, HB 2009 also provides several other notable protections for borrowers during the emergency period, which began at the beginning of this year. First, if a borrower notifies the lender that the borrower cannot make a payment because of lost income from the COVID-19 pandemic, the lender cannot treat the borrower’s non-payment of any amount due to the lender during the period as a default. After such notification and, unless otherwise agreed by lender and borrower, the lender must defer collecting payment and must permit the borrower to pay the amount deferred during the emergency period to the loan’s maturity date. Further, once the borrower gives that notice to the lender, a lender may not:

(A) Impose charges, fees, penalties, attorney fees or other amounts that the lender might have otherwise imposed or collected from a borrower for failing to make payment;

(B) Impose a default rate of interest that the lender might have imposed or collected from a borrower for failing to pay an amount otherwise due during the emergency period;

(C) Treat the borrower’s failure pay any amount due during the period as an ineligibility for a foreclosure avoidance measure; or

(D) Require or charge for an inspection, appraisal or broker opinion of value during the emergency period.

The new law also creates a private right of action for borrowers to recover damages for an ascertainable loss of money or property due to the prohibited actions of a lender or trustee and allows the borrower to recover attorney’s fees and costs as well. A lender is not liable for damages for acts taken before the lender receives the lost income notice from the borrower.

The protections of HB 2009 were initially set to expire on June 30, 2021, however, the law authorized the Governor to extend the mortgage foreclosure moratorium period for two successive three-month periods by executive order. On June 11, 2021, Governor Brown announced that she had extended the moratorium for that first three-month period, until September 30, 2021, and, if the Governor intends to extend the moratorium again, the Governor must do so by August 16, 2021.

By David Venables

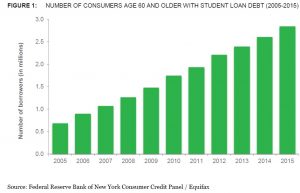

New CFPB Report: Student Loan Debt of Older Consumers Quadrupled Over Past Decade

Earlier this month, the CFPB’s Office for Older Americans and Office for Students and Young Consumers released its “Snapshot of Older Consumers and Student Loan Debt” which revealed a troubling statistic – the number of consumers age 60 and older with student loan debt has quadrupled over the last decade in the United States. In 2015 alone, older consumers owed an estimated $66.7 billion in student loans and consumers age 60 and older are the fastest growing age-segment of the student loan market.

The CFPB noted that this trend is not only the result of borrowers carrying their own student debt later into life but a growing number of parents and grandparents are financing their children’s and grandchildren’s college education, taking out the loans directly or co-signing on a loan with the student as the primary borrower.

Older borrowers entering retirement with student loan debt face a number of challenges that may contribute to their inability to repay their student loans or meet their responsibility for their children’s loans. Unlike younger borrowers, who generally have more time in the workforce to increase their income and pay off the debts, older consumers typically experience a decrease in income as they age. In addition, some older consumers face other challenges, such as an increased incidence of physical and cognitive impairments associated with aging. These challenges may limit the ability to remain in the work force and may be associated with a decline in income.

The CFPB Report can be found below:

Snapshot of older consumers and student loan debt

Oregon Department of Justice Scam Prevention Tips

-

Scammers Contact You “Out Of The Blue”

-

Scammers Claim There Is An “Emergency”

-

Scammers Ask For Your Personal Information

-

Scammers Want You To Wire Money

-

Scammers Tell You To Keep It “Secret”

-

Scammers Make It Sound Too Good To Be True

JUST HANG UP THE PHONE ON IMPOSTER SCAMS

Consumer Financial Protection Bureau Expands Foreclosure Protections for Borrowers

Consumer Financial Protection Bureau Expands Foreclosure Protections for Borrowers

On August 4, 2016, the Consumer Financial Protection Bureau (CFPB) finalized new measures to ensure that homeowners and struggling borrowers are treated fairly by mortgage servicers, including:

- Requiring servicers to provide certain borrowers with foreclosure protections more than once over the life of the loan,

- Expanding consumer protections to surviving family members and other homeowners,

- Providing more information to borrowers in bankruptcy,

- Requiring servicers to notify borrowers when loss mitigation applications are complete,

- Protecting struggling borrowers during servicing transfers,

- Clarifying servicers’ obligations to avoid dual-tracking and prevent wrongful foreclosures, and

- Clarifying when a borrower becomes delinquent.

The CFPB’s press release and link to rules is here.

National Consumer Protection Week March 1-7

National Consumer Protection Week (NCPW) is a coordinated campaign that encourages consumers nationwide to take full advantage of their consumer rights and make better-informed decisions. Find out more at:

In recognition of National Consumer Protection Week, the Oregon Department of Justice has released its 2014 list of Top 10 Consumer Complaints